Contents

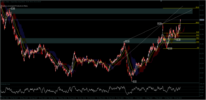

These Fibonacci ranges do not must be precise, but the closer they’re, the more reliable the pattern. The confluence of those levels within the Fibonacci Grid construction, together with emerging sample construction (and pattern goal/cease levels), helps a trader make a great choice. To generate trading signals, the pattern must conform with price, time, and Fibonacci ratio.

To complete the pattern, a point D forms above point B, and it is the highest data point between C and D. CD is ideally 127.2 or 161.8 percent of AB or 127.2 or 161.8 percent of BC. Traders wait for symmetry between Fibonacci ratio, time, and price to plan a trade, that is, to go short. We examine how to use this pattern, its variations, and a couple of useful indicators that you can use when trading this pattern on the markets. In this method a trader is simply doing what all the other traders are doing, because trading with the trend increases probability. Use it like a risk vs reward drawing tool, watch it auto calculate.

How do you trade a Gartley pattern?

Gartley which was written in his book- “Profits in the Stock Market”. The price difference between B and C is about 61.8% of the price difference between B and A. If the price moved to TP1 fast, the odds are that it will continue towards TP2. On the contrary, if the price is slow to get to TP1, this might mean that it will be the only TP level you’ll get. Notice that a 61.8% retracement at the point C tends to result in the 161.8% projection of BC, while a 78.6% retracement at the C point will lead to the 127% projection. Then you have C point which is a retrace of the A-B leg by specific Fibonnaci ratio and that is 61.8%.

Since then, varied books, buying and selling software program, and different patterns have been made based mostly on the Gartleys. We can attempt to stay on this trade for additional revenue and use price motion alerts to information us. As you see, the worth creates a pair extra peaks on the chart.

- As Larry Williams says “the market is filled with twists and turns”.

- Harmonic patterns (5-point) have a critical origin followed by an impulse wave followed by a corrective wave to form the “EYE” at completing AB leg.

- The similar anomalies could be discovered in the financial markets, such as in harmonic patterns.

- So I wonder if in real time this causes the P1 and V1’s to be repainted, meaning that if more data comes in the location of P1 and V1 may change.

- Markets started the week on a feeble note and lost over half a percent, in continuation of the prevailing corrective phase.

- Then you have C point which is a retrace of the A-B leg by specific Fibonnaci ratio and that is 61.8%.

There will be 2 internal loops first one will print spaces and the other will print the character. You can see in this pattern character is changing throughout the row but reset to A after every row. To change the character in every iteration you can set a counter and increment it by 1 every time in the inner loop.

xabcd

The updated code is nicer because if you want to display just the Bullish Gartley then all the unnecessary clutter is removed from the chart. Without exhausting my brains too much I just used the replay function of Amibroker and indeed this code repaints. So it finds a P1 or V1 initially but these peaks and troughs need to be confirmed. So initially it might draw a V1 trough and possibly another one and another one giving you 3 V1’s in a row.

Using the triangles created throughout the butterfly, merchants can determine whether or not holding a short or a protracted place is the most profitable. These four levels on the chart are the 4 minimal targets of the bullish Gartley. That doesn’t imply that the bullish pattern will finish when the value completes level E.

You’ll have the ability to know when the best time to commerce is and when the market is going to react in a certain way. ThisAmazing Harmonic Pattern Trading Strategy https://1investing.in/ provides you with a complete new understanding of the worth action. Our group at Trading Strategy Guides know the geometric patterns that may be present in nature.

There are numerous patterns which fall into the “harmonic” group, but at present we will highlight one of many oldest acknowledged harmonic patterns – the Gartley sample. In the next material, will dive into some guidelines and greatest practices around trading the Gartley pattern. Our system scans by way of thousands of securities each second to search out the best buying and selling alternatives for you.

If XA, AB swings takes 5 bars, then usually it takes around that much more time to complete the pattern. Such small patterns should be observed with lower “strength” levels.We can get small patterns with strength levels of 2 or 1. Also, the Nifty has formed a bullish harmonic pattern which does point toward a quick recovery in the markets. Nifty is currently in a major support zone and it is stabilising in this zone.

Harmonic patterns, however, are established through clear price structure and Fibonacci measurements. ABCD harmonic pattern is the simplest one of all harmonic patterns because it has only two Fibonnaci ratios you must follow. Most technical merchants use chart analysis with market context ideas to trade. Each trader develops his personal market context to commerce. Most technical traders use chart evaluation with market context ideas to commerce.

Price Data sourced from NSE feed, price updates are near real-time, unless indicated. Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary.

Real World Example of a Gartley Pattern

Gartley discusses the Gartley sample and refers to it as “top-of-the-line trading opportunities” out there. And so, the Gartley pattern can be sometimes known as Gartley 222 or the 222 pattern by some harmonic traders. If you’ll be able to learn to acknowledge these patterns early they’ll help you to gain an actual competitive advantage in the markets. Most harmonic sample commerce entries happen round “D” level throughout the reversal zone.

Its very likely it will touch 76.00 levels once ..I hope by tomorrow noon . Bitcoin seems to be finally out of the woods after rallying past $45,000 following an eleven-week-long consolidation. As of writing, the pioneer cryptocurrency is trading at $47,503 and is up 16% in the past 7 days…

Trading Strategies using Average Directional Index (ADX)

One of the elegant ways to define market context is thru a Fibonacci Grid construction. All the price swings between these factors are interrelated and have harmonic ratios based on Fibonacci. Most technical traders use chart analysis with market context concepts to trade. One of the elegant ways to define market context is through a Fibonacci Grid structure.

I am also posting a copy of the code here, because in past the site wisestocktrader.com has put code behind registration and pay walls. Here you can find the meaning of Find the missing figure in the pattern.a)b)c)d)Correct answer is option ‘B’. Besides giving the explanation of Find the missing figure in xabcd pattern the pattern.a)b)c)d)Correct answer is option ‘B’. Has been provided alongside types of Find the missing figure in the pattern.a)b)c)d)Correct answer is option ‘B’. Theory, EduRev gives you an ample number of questions to practice Find the missing figure in the pattern.a)b)c)d)Correct answer is option ‘B’.

Each wave of this triangle is shorter than the previous one, which means wave doesn’t break the beginning point of the wave , wave doesn’t break the starting point of the wave etc. On the next chart, you can see a triangle in the position of the fourth wave, so a five-wave decline happened right after the pattern. To trade the pattern takes time and see what works and what does not. You can find a link to download the ABCD pattern indicator below. As with the bullish ABCD pattern, the bearish pattern begins with a sharp move to the upside.

.jpeg)

.jpeg)

.jpeg)